Queenstown Property Overview

|

Queenstown - Short history, big change.

Queenstown began during the 1860’s as a sleepy hollow, founded on settler farming and a gold rush, and it’s now New Zealand’s leading tourist destination. Early pioneers paved the way for the area’s farming and tourism industries. Visitors from around the country and the globe travelled by horse and buggy and boat to Queenstown - the ‘town fit for a Queen’. Queenstown’s tourism industry was largely summer-focused, until the advent of commercial skiing with the opening of Coronet Peak in 1947.

In the 1950’s and 60’s a flourish of holiday cottages began springing up around Queenstown, Frankton and Arrowtown. Family holidays were enjoyed boating on the lake in summer and skiing during winter. Jet-boats began taking thrill-seekers up local rivers from the 1950’s and by the 1970’s tourists were rafting Queenstown’s whitewater rapids. The adventure tourism boom firmly cemented Queenstown on the world stage when AJ Hackett launched the first commercial bungy jump in 1988.

Tourism brought with it an increased demand for property. Fast-paced development and tourism growth during the past 30 years has not only bolstered the property market but Queenstown Airport has expanded multiple times to meet this increased demand. Queenstown’s first international trans-Tasman flight landed from Sydney in 1995. Today Queenstown Airport hosts almost two million passengers a year – one quarter of them international tourists.

What did this mean for Queenstown Real Estate?

1862 -1980: Queenstown - A town with a Golden Ticket.

Prior to the 1980’s, Queenstown was a holiday village, based around the winter and summer seasons and where property values had remained relatively static for years. At this time approximately eighty-five percent of property transactions were made to local and regional buyers - approximately half for owner-occupation and approximately half for investment/holiday purposes. Buyer interest in the town increased in the late 1970’s.

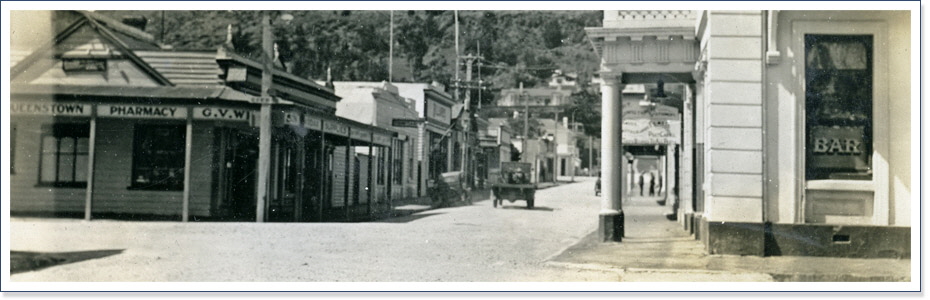

(Queenstown (Ballarat Street) in the 1930’s)

1980 – 2010: Small town is recognised and connected internationally.

Property values began to rise and then accelerate during the early 1980’s. Over this boom period, property values generally increased by a factor of between two to three times. The residential market was the first to move. Developable tourist accommodation/servicing zoned property soon followed. Rural lifestyle blocks showed similar demand and increases. Buoyancy continued generally until late 1986. The property cycle peaked at this time.

The stock market crash of October 1987 and the resultant depressed financial climate left many investors holding low or non-income earning property that they desired, or had to off- load and which then provided a market over supply of all property. By late 1989, the majority of pressured vendors had been removed from the market and together with an apparent rural economic recovery, lower interest rate expectations, the upgrading of Queenstown’s airport to become nationally jet capable, the announcement of some larger development projects and higher projected tourist numbers, the Queenstown property market began to show signs of cautious optimism.

(Queenstown Airport -present day)

The cycle turned for the rise in early 1991, resultant in part from the sustained optimism but to a greater extent as a result of an increased enquiry/purchasing from off-shore - mainly in prime lake front, commercial and tourist accommodation property. These off-shore purchasers entering the market acted as a significant catalyst to recovery. In effect this period represented a ‘discovery’ of Queenstown by the offshore market. Over the subsequent three year period of strong growth, a lack of supply and dramatic increased enquiry and demand saw all property show significant realty growth. The market peaked in the mid 90’s.

Demand then eased and a ‘buyer’s market’ situation generally remained until the late 90s, due largely to the ongoing uncertainty in global currency and equity markets and the resultant caution from buyers when considering any purchase. Subsequently, evidence of growth in global economies and of an Asian economic recovery, together with an emerging overall confidence within the Lakes District, resulted in an increase in purchaser enquiry. Although reasonable confidence remained within local retail, tourism, construction and real estate sectors, the fall-out from the ”tech wreck” in March 2000 resulted in a temporary return of buyer caution.

With Internet connectivity making it possible to live or stay for an extended time and to work remotely, the economic and terrorist events of the early 2000’s did not slow our local property market - rather, local sales volume and value growth from early to mid-2000’s was significant. Prospective purchasers at every price level continued to compete strongly for the limited supply. The strength and growth subsequent to September 2001 was unprecedented. Enquiry/demand for upper end property was unprecedented, as was offshore interest. This created substantial value growth to the upper end sector which resulted in the evolution of a multi-level market from that of the broad mono-value one of the past.

However, with global concerns rising, from mid-2007, the market trended to a steadying/softening, with sales turnover dropping, time to sell lengthening, and the annualized median sale price growth easing. Throughout the first quarter of 2008, the national and local property markets actualized to a buyer’s market. All market benchmarks softened. Whilst stock supply increased and buyer hesitancy became more prevalent, especially in light of continued global credit concerns, realistically priced stock in all property categories and price ranges continued to sell. Demand and enquiry generally ceased in late 2008 as a result of the Global Financial Crisis. This situation continued for a number of years.

(Queenstown Mall (Ballarat Street) - present day)

2010 – Present: Micro-City or Macro-town?

Subsequently, distress in the market was generally replaced with a return to reasonable supply/demand equilibrium. Any reasonably priced stock continued to sell. Sellers were realistic with pricing and buyers were committing if fair value was perceived. From early 2013 a shortage of stock became evident. Buyers remained willing to purchase any correctly priced property. Subsequently, a marked increase in buyer confidence and enquiry became evident. Buyer confidence and activity intensified in mid-2015. The shortage of stock continued and multiple offers became commonplace. Sale prices lifted. This ‘sellers’ market strengthened during the second half of 2015 and continued until early to mid 2018. Although some urgency to transact from a buyer's perspective came out of the market during 2018 and 2019, buyers continued to chase the limited supply of stock. The market was in reasonable equilibrium, but changed in early 2020 when low interest rates increased buyer demand and caused prices to rise in a seller's market. This continues.

(Queenstown from the Skyline Look-out)

Queenstown Property Ownership

|

The Queenstown Lakes District incorporates the main urban centres of Queenstown, Wanaka, Arrowtown and Frankton and the surrounding Lakes District including Glenorchy, Kingston, Lake Hayes, Gibbston, Hawea, Alberttown and Luggate settlements.. The townships of Cromwell and Alexandra are within the neighbouring Central Otago District.

Property Ownership within the Queenstown Lakes District is approximated as 50% Local, 20% Regional (Southland/Otago), 15% Rest of New Zealand and 15% International. The geographic origin of the "International" proportion comprises approximately 70% Australian, 5% North American, 15% Asian, 5% United Kingdom, and 5% rest of the world.

|